| Ticker | ARKW (ARK Next Generation Internet ETF) |

|---|---|

| ARKW Price | $76.4 |

| Portfolio Manager | Catherine D. Wood |

| Top Holdings | Tesla, Roku, Coinbase |

| Top Sector | Info Tech and Communication Services |

| Expense Ratio | 0.83% |

| Return Since Inception | 483.72% |

| ARKW Dividend Yield | % |

ARKW Holding is a company with shares that make up an Exchange Traded Fund (ETF) and actively looks for investments in companies that relate to the internet.

Fund objective is to seek growth by investing (at least 80% of its assets) in domestic and the U.S. publicly traded companies with businesses focused on the internet sector, e-commerce, social media platforms, cloud storage, streaming services, software as a service (SaaS), online advertising services, ad technology, new payment methods, big data or related industries.

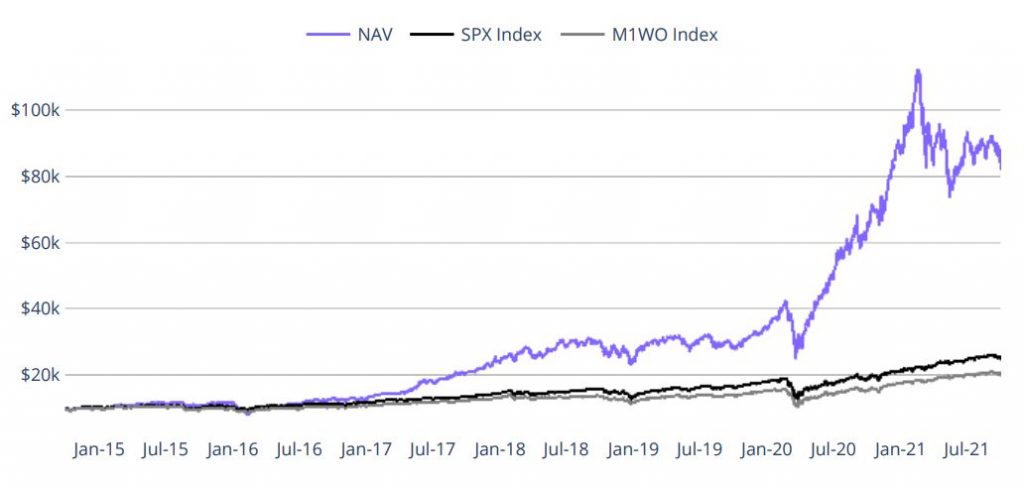

ARKW ETF Price Chart

| Stock | Price | Change | Change % | Volume | 52 Week Range |

|---|---|---|---|---|---|

ARK Next Generation Internet ET ARKW | $76.7 | $0.39 | 0.51% | 183,881 |

ARKW Stocks Holding List (Updated)

(Download The Latest List Below)

Similar ARK ETFs List –

ARKQ, ARKK, ARKF, ARKG, ARKX, and PRNT

ARKW Annual Performance

| ARKW | NAV | Market Price |

| 2022 | -67.49% | -67.49% |

| 2021 | -16.65% | -16.71% |

| 2020 | 157.08% | 157.46% |

| 2019 | 35.80% | 35.76% |

| 2018 | 4.54% | 4.18% |

| 2017 | 87.18% | 87.32% |

| 2016 | 8.73% | 8.31% |

ARKW vs QQQ vs ARKK Returns

| Year | ARKW | ARKK | QQQ |

| 2017 | 87.32% | 87.34% | 32.70% |

| 2018 | 4.18% | 3.52% | -0.14% |

| 2019 | 35.76% | 35.08% | 39.12% |

| 2020 | 157.46% | 152.82% | 48.60% |

| 2021 | -16.71% | -23.38% | 27.24% |

| 2022 | -67.49% | -66.99% | -32.51% |

Important Note: Market returns are based on the trade price at which shares are bought and sold on the Cboe BZX Exchange, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times.

Total Return reflects the reinvestment of distributions on ex-date for NAV returns and payment date for Market Price returns. The market price of the ETF’s shares may differ significantly from their NAV during periods of market volatility.

Related Post –

Exposure Breakdowns

Here are the few charts that explain where is ARKW ETF Holding…

Should You Invest In ARKW?

ARKW ETF focused on shifting technology infrastructure to the cloud, enabling mobile, internet-based products and services, new payment methods, big data, artificial intelligence, the internet of things, and the social media sector.

Based on the report, if you invest $10,000 in this ARKW ETF fund, you’ll get better returns than the S&P 500 Returns.

Frequently Asked Questions

Q. What are the top holdings of the ARKW Fund?

TESLA INC

COINBASE GLOBAL INC -CLASS A

GRAYSCALE BITCOIN TRUST BTC

BLOCK INC

ROKU INC

ZOOM VIDEO COMMUNICATIONS-A

TELADOC HEALTH INC

TWILIO INC – A

SPOTIFY TECHNOLOGY SA

SHOPIFY INC – CLASS A

Q. What are the charges of ARKW?

The expense ratio of ARKW ETF is 0.83%

Q. Does ARKW hold Bitcoin?

Yes! ARKW ETF holds GRAYSCALE BITCOIN TRUST BTC almost 8%-9%, so that means an investor who invests in ARKW fund gets indirect exposure to bitcoin.

Q. Is ARKW Fund is Risky?

If you come blindly, there is risk in the entire stock market. Taking about ARKW, It’s like a mutual fund, which is managed by a team of experts and ensures that you get a better return on your investment. It also keeps looking for new opportunities, so sometimes an investor’s portfolio goes down due to market volatility. But long story short no doubt ETFs are a good investment in the long run.

Disclaimer ✋

The information included at this site is for educational purposes only and is not intended to be a substitute for investment advice. Data on past performance, where given, is not necessarily a guide to future performance. So before investing you should carefully consider the Fund’s investment objectives, risks, charges, and expenses.

0 Comments