ARKQ Holdings is an (ETF) fund that invests in the leading disruptive companies. Its portfolio will change as these companies change. It’s essential to regularly monitor market conditions and adjust the portfolio accordingly because what used to be a killer technology one day becomes a relic the next.

Managing a portfolio is balancing between carrying companies through their ups and downs, investing in multi-year disruptive technologies, and taking advantage of short-term opportunities that proliferate.

ARKQ Stocks Holding List

(Download The Updated ARKQ List Below)

ARKQ Overview

| Stock | Price | Change | Change % | Volume | 52 Week Range |

|---|---|---|---|---|---|

ARK Autonomous Technology & Rob ARKQ | $54.1 | $0.27 | 0.50% | 124,860 |

ARKQ fund focused on Innovation, Growth Potential, Diversification, and Research, so they can choose companies that are expected to benefit from the development of new products or services, techno improvements, and advancements in scientific research related to, among other things, energy, automation and manufacturing, materials, artificial intelligence.

Related Post –

- ARKK Holding List

- ARKW Holding List

- ARKG Holdings List

- Fortune 100 Stocks List

- Top 5 ETFs For Nasdaq-100

- Over The Counter Stocks

ARKQ Performance

Annualized Returns

| ARKQ | NAV | Market Price |

| 1 Year | -25.51% | -25.63% |

| 3 Years | 15.41% | 15.38% |

| 5 Years | 9.92% | 9.89% |

| Since inception | 12.38% | 12.39% |

Calendar Year Returns –

| ARKQ | NAV | Market Price |

| 2022 | -46.70% | -46.75% |

| 2021 | 1.90% | 1.75% |

| 2020 | 106.70% | 107.22% |

| 2019 | 25.95% | 25.94% |

| 2018 | -7.57% | -7.89% |

| 2017 | 52.41% | 52.27% |

| 2016 | 14.71% | 14.51% |

Important Note: Market returns are based on the trade price at which shares are bought and sold on the Cboe BZX Exchange, Inc. using the last share trade. Market performance does not represent the returns you would receive if you traded shares at other times.

Total Return reflects the reinvestment of distributions on ex-date for NAV returns and payment date for Market Price returns. The market price of the ETF’s shares may differ significantly from their NAV during periods of market volatility.

Exposure Breakdowns

Here are the few charts that explain where is ARKQ ETF Holding…

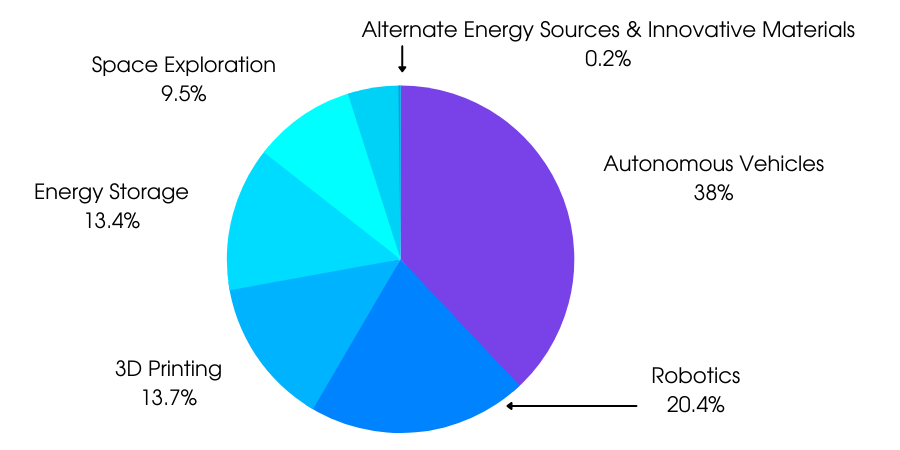

1 TECHNOLOGY BREAKDOWN

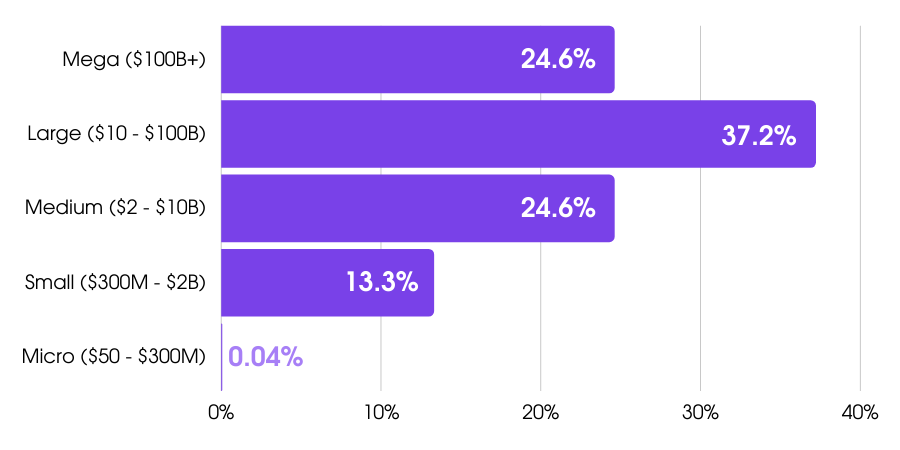

2 MARKET CAPITALIZATION

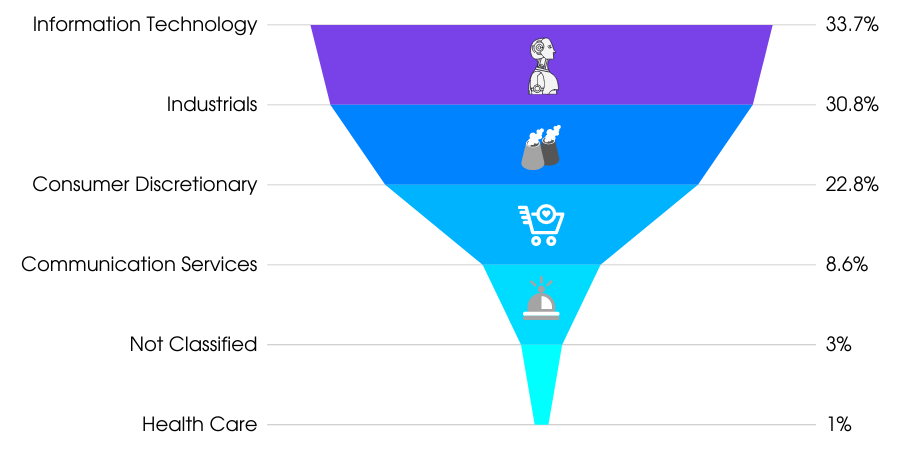

3 SECTOR BREAKDOWN

Should You Invest In ARKQ?

ARKQ ETF is all about the future. It’s focused on Innovation, Growth Potential, Diversification, and Research to choose valuable companies in Autonomous Vehicles, Robotics, 3D Printing, Energy Storage, Space Exploration, Development of Infrastructure, Innovative Materials, and Alternate Energy Sources sectors.

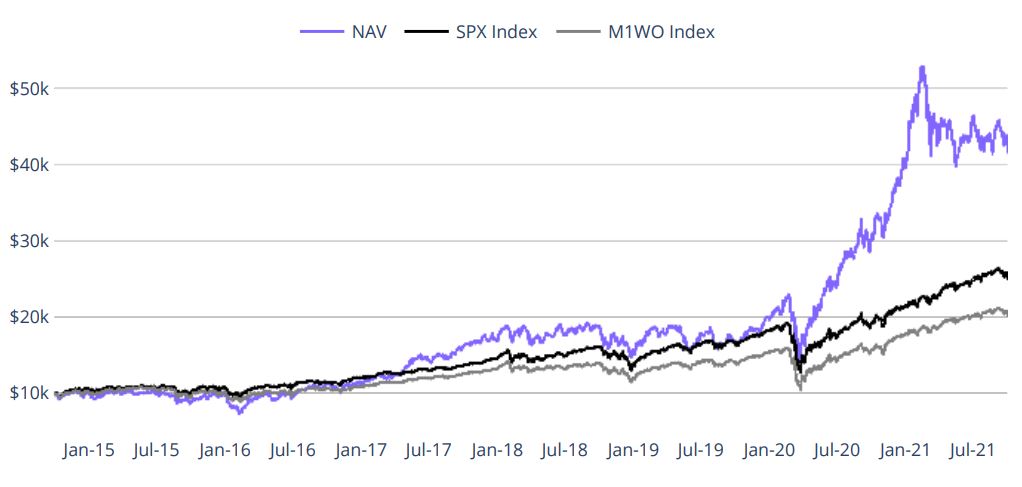

Based on the report, if you invest $10,000 in this ARKQ ETF fund, you’ll get better returns than the S&P 500 Returns.

Frequently Asked Questions

1. TESLA INC

2. UIPATH INC – CLASS A

3. KRATOS DEFENSE & SECURITY

4. TRIMBLE INC

5. UNITY SOFTWARE INC

6. IRIDIUM COMMUNICATIONS INC

7. 3D SYSTEMS CORP

8. KOMATSU LTD -SPONS ADR

9. JD.COM INC-ADR

10. DEERE & CO

The expense ratio of arkq ETF is 0.75%

There are many ARK ETFs – ARKK, ARKF, ARKW, ARKG, ARKX, PRNT, and IZRL.

If you come blindly, there is risk in the entire stock market. Taking about ARKQ, It’s like a mutual fund, which is managed by a team of experts and ensures that investors get a better return on their investment. It also keeps looking for new opportunities, so sometimes an investor’s portfolio goes down due to market volatility. But long story short no doubt ETFs are a good investment in the long run.

Desclaimer ✋

The information included at this site is for educational purposes only and is not intended to be a substitute for investment advice. An investor may get back less than the amount invested. Information on past performance, where given, is not necessarily a guide to future performance. So invest carefully…

What to do Next?

Thank you for reading this post. I hope you’ve liked it. If you have, then please share it with your friends and also tell me in the comments which investment fund you’re likely to invest in 🙂

0 Comments