Nasdaq-100 Index Today - NDX Price Chart

52 Week Range 52 Weeks High 52 Weeks Low $18,464.7 $12,938.5

Nasdaq Stocks Today

Tech companies play a vital role in the performance of the Nasdaq-100 Index as the technology sector has more than 55% of weightage in the index.

Stock Price Marketcap Sector Open High Low Close Volume 52 Week Range $169.3 2.6T $169.9 $171.3 $169.2 $169.9 44,456,222 $406.3 3.0T $412.4 $413.0 $405.8 $399.0 29,613,265 $179.6 1.9T $177.7 $180.8 $176.1 $173.7 41,954,611 $168.3 536.7B $169.1 $172.1 $166.4 $170.2 108,830,097 $173.7 2.1T $175.9 $176.4 $171.4 $158.0 55,109,185 $172.0 2.1T $174.4 $174.7 $169.7 $156.0 64,533,393 $0.0000 0.0000 $0.0000 $0.0000 $0.0000 $0.0000 0 $877.4 2.2T $839.0 $883.3 $833.9 $826.3 54,608,830 $1,344.1 622.9B $1,310.0 $1,355.8 $1,303.1 $1,294.4 2,386,760 $175.6 241.4B $174.4 $178.6 $174.3 $176.7 4,462,451

What is the Nasdaq-100 Index?

Nasdaq-100 (NDX) is a capitalization-weighted stock market index that reflects the performance of 100 non-financial companies listed on the Nasdaq Stock Exchange.

Nasdaq-100 does not include financial stocks but covers all other major sectors like Biotechnology, Industrial, Technology, Retail, Health Care, Media, etc. The index sometimes refers as the "US Tech 100" as the technology industry has more than 55% of the weight in the index.

Currently, the index has 102 equity stocks of 100 domestic and international companies as few companies (Google & Fox Corporation) have multiple classes of shares.

The Nasdaq 100 is also tracked by the QQQ, which is the world's top growth-focused ETF.

Nasdaq-100 Index Methodology

The Nasdaq-100 index is calculated based on the modified market capitalization method. The weight of every stock in the index is determined based on the market cap with few modifications. The reason to use the modified system is to prevent too much influence of the largest companies in the index and allow diversification.

The index constituents are selected once every year in December based on specific eligibility criteria.

The index weight is rebalancing is announced every quarter in March, June, September, and December. Securities' last closing prices of Feb, May, Aug, and November months are multiplied with outstanding shares to create a quarterly rebalancing effect.

And if the integrity of the index breach, then a Special Rebalance process may be conducted at any time.

Check - Dow Jones Industrial Average

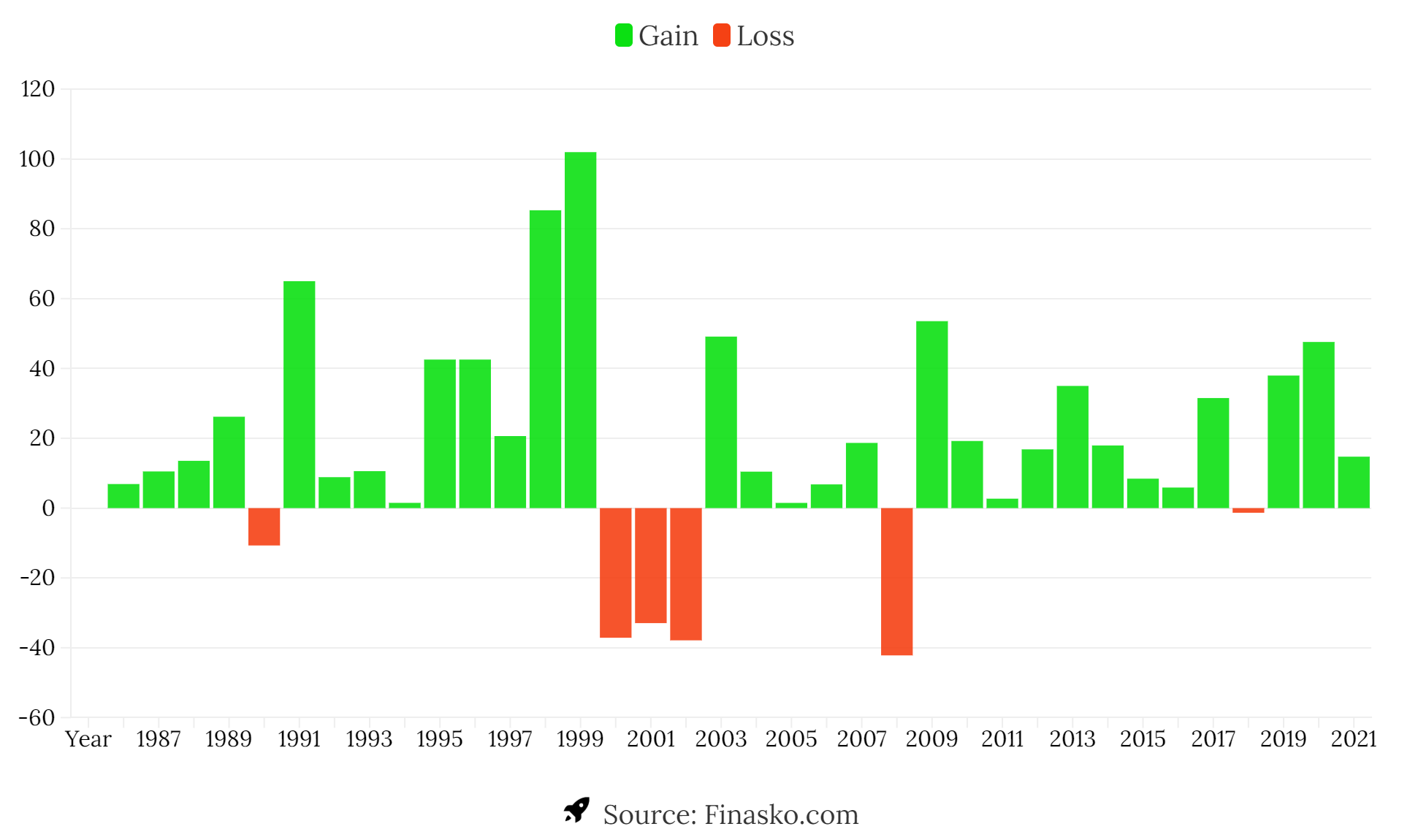

Nasdaq-100 Historical Return

NASDAQ-100 is a great investment option for investors who want to invest in a technology-based diversified portfolio. Nasdaq-100 has generated 21.53% of the annual average (CAGR) return in the last 10 years.

Check here the historical performance of NASDAQ-100 index:

Nasdaq 100 vs S&P 500

Nasdaq-100 and S&P 500 are the two most popular equity indices in the US. Here are some differences between these indexes -

1. Nasdaq 100 includes only non-financial companies listed on the Nasdaq stock exchange, while the S&P 500 Index represents the top 500 large-cap companies from all sectors listed on NYSE or NASDAQ.

2. Standard & Poors' stocks are ranked based on their weighted market capitalization. In Nasdaq-100, rebalancing is decided based on the modified capitalization method.

3. The information technology sector has a 27.6% weight in S&P 500, while Nasdaq 100 is a tech-heavy index with 55.45% weight of the technology sector.

4. Compare Nasdaq-100 with S&P 500 Return (10 years performance of both indices) -

Nasdaq 100 vs Nasdaq Composite

The Nasdaq Composite is the standard index used to rate the overall performance of stock market in United State. It's a market cap weighted index based on QQQ or Technology Select Sector Index, which represent 3000+ components listed on Nasdaq Exchange.

How to Invest In Nasdaq 100

As you can't directly invest in an index, to invest in Nasdaq-100, you can buy Nasdaq-100 Exchange-traded fund or Index Funds. Check the below link to know about the best Nasdaq-100 ETFs or Index Funds: invest in Nasdaq 100

Frequently Asked Questions

The Nasdaq has 100 companies and 102 equity stocks with different classes of shares.

These are some eligibility criteria to include securities in Nasdaq 100 -

- Every ordinary and common stock can be part of Nasdaq 100, and there is no minimum market cap required.

- It has been at least two years since the stock was listed on the Nasdaq stock exchange.

- The stock should trade on high volume like 200000 shares a day.

- Also, the company needs to report quarterly & annually and should not have any bankrupt cases.

Nasdaq 100 index is a safe way to invest in most tech-based companies for long-term investment goals.

1 Year +48.88%

5 Year +196.31%

10 Year +552.24%

Since Inception* +784.07%

- Apple Inc.

- Microsoft Corp.

- Amazon.com Inc.

- Facebook Inc. A

- Alphabet Inc. A (GOOGL)

- Tesla

- Nvidia

- Alphabet Inc. C (GOOG)

- Paypal

- Adobe

- Technology: 56.14%

- Consumer Services 24.9%

- Health Care: 9%

QQQ ETF is the best For low fees, high liquidity.

Gain +101.95% (1999)

Loss -41.89% (2008)

Share This Article

Abhishek Vyas

Abhishek has experience of 4 years in Finance Content writing. He writes on investing in Stock Market and Cryptocurrencies.