What is the Dividend ETFs?

Dividend ETFs are a basket of securities that pay out dividends. They have low fees, and you can buy and sell them quickly like a common stock from online brokers worldwide; also, they are a close substitute for other fixed-income investments such as bonds and high yield stocks.

These are a popular investment option with investors looking to get a steady payout for a portion of their portfolio. They are often used by 401(k) retirement plans and other types of individual retirement accounts (IRAs).

Why to Invest In Dividend ETFs

- Easily tradable and manageable.

- Best way to increase passive income.

- Dividend-paying stocks in one basket.

- They offer Diversity and High Efficiency.

- Has low cost than owning individual stocks.

- Safe from portfolio fluctuate in market ups & downs.

How to Select Best Dividend ETFs?

As per the reports, if you invest in the right ETF and reinvest the dividend you get from them, you can get a higher return than the S&P 500 total return. But there is a lot of confusion in selecting the right ETFs and the dividend income they will provide. So, we look at 5 points you need to ask before investing in these funds.

1. Dividend Yield: The dividend yield of an ETF is the percentage (%) of the fund’s price paid in dividends during the last 1 year. For example – You buy an XYZ ETF at the $250 price, and in the last 12 months, they pay $25 in a dividend, which means the dividend yield is 10% (25*100/250). You have to select those dividend ETFs that constantly pay a dividend or have a good dividend yield history.

2. Expense Ratio: The expense ratio is the amount of money you pay out of your pocket to buy or sell the exchange-traded fund. For long-term holders, differences with only 0.15% in expense ratios can cost thousands of dollars—that’s why it’s crucial to understand that lower expense ratios mean you can maximize the return on your ETF investment.

3. Fund Performance: A company might show its financial stability by rewarding investors with cash dividends. The total return of capital from a fund might depend on how well that fund is performing because the higher its performance, the higher the number of dividends it will pay.

4. AUM: How much assets are managed by ETF is called AUM (Assets Under Management). It’s also essential for Dividend ETF Investors because if you can’t sell ETFs when you want, it will create differences in your total returns – So, to avoid the Liquidity issue, you need to choose ETFs with Higher AUM.

5. Diversification: Don’t buy those ETFs with almost identical top holdings because it increases your risk with the stock market ups and downs. Always consider the diversification with stocks and sectors to maximize return and safety.

Best High-Dividend ETFs (2023)

If you’re an investor who is interested to boost your portfolio income, then you have probably considered the high-yield exchange-traded fund (ETF). In this blog post, we ranked the Best Dividend ETFs based on the history of dividend, expense ratio, dividend yield, performance, and assets under management.

| Dividend ETF | Dividend Yield |

| JPMorgan Equity Premium Income ETF (JEPI) | 7.31% |

| iShares Select Dividend ETF (DVY) | 3.02% |

| Schwab US Dividend Equity ETF (SCHD) | 2.88% |

| Vanguard Dividend Appreciation ETF (VIG) | 1.71% |

| Vanguard High Dividend Yield ETF (VYM) | 2.78% |

| SPDR S&P Dividend ETF (SDY) | 2.66% |

Note: Before making any investment decision, it’s important to research on your own level.

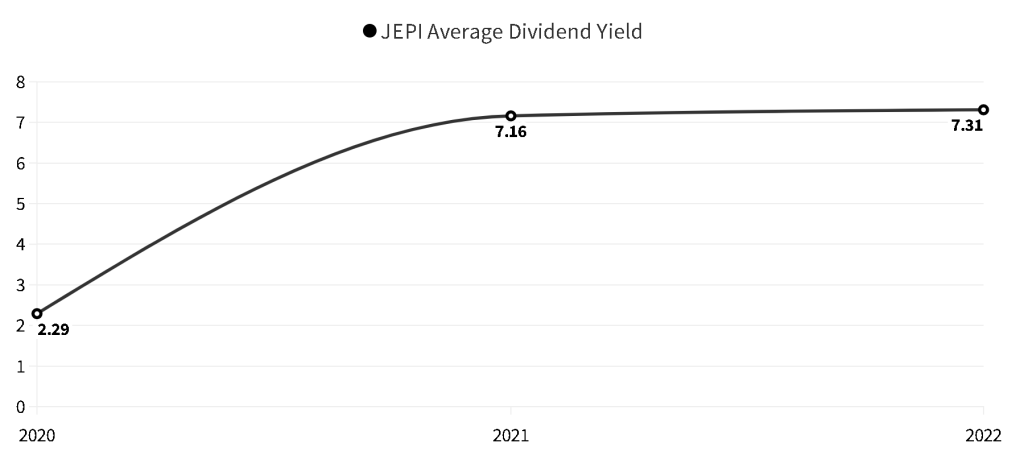

#1 JPMorgan Equity Premium Income ETF (JEPI)

- Price: $55.9

- AUM: $8.73B

- Expense Ratio: 0.35%

- Dividend Yield: 7.31%

- Dividend Payout: Monthly

- Last Year Total Return: 21.61%

- QYLD Top Holdings: Progressive, Bristol Myers Squibb, Microsoft, UnitedHealth Group

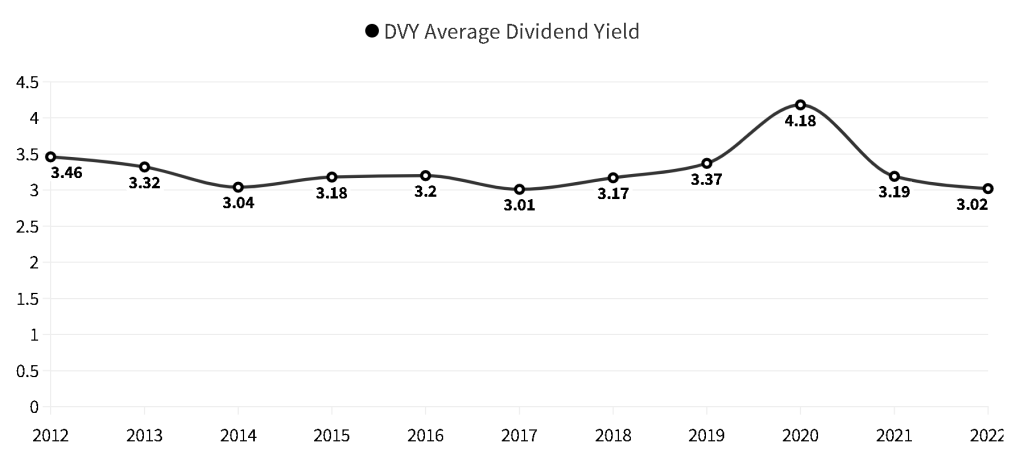

#2 iShares Select Dividend ETF (DVY)

- Price: $119.4

- AUM: $21.62B

- Expense Ratio: 0.38%

- Dividend Yield: 3.02%

- Dividend Payout: Quarterly

- Last Year Total Return: 31.63%

- DVY Top Holdings: IBM, ONEOK, LyondellBasell, Philip Morris, Gilead, Exxon Mobil

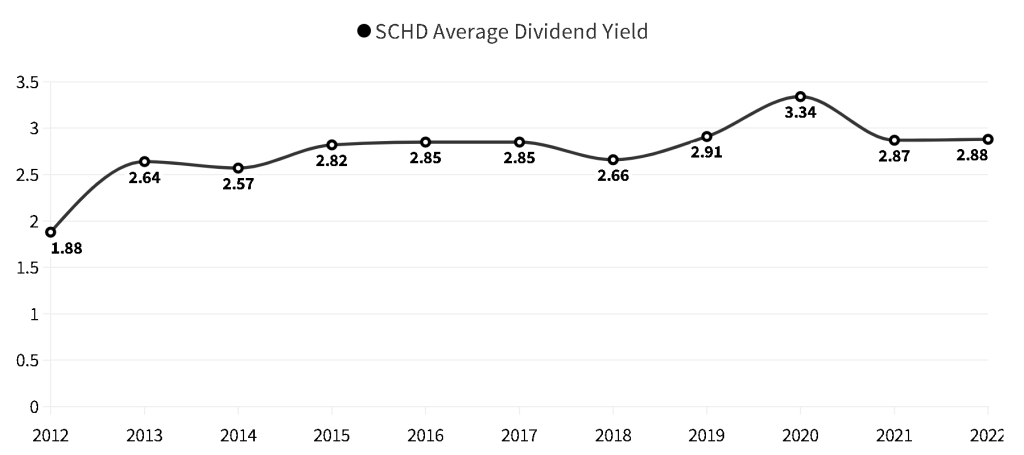

#3 Schwab US Dividend Equity ETF (SCHD)

- Price: $77.0

- AUM: $34.16B

- Expense Ratio: 0.06%

- Dividend Yield: 2.88%

- Dividend Payout: Quarterly

- Last Year Total Return: 29.78%

- SCHD Top Holdings: Broadcom, Coca-Cola, Amgen, Cisco

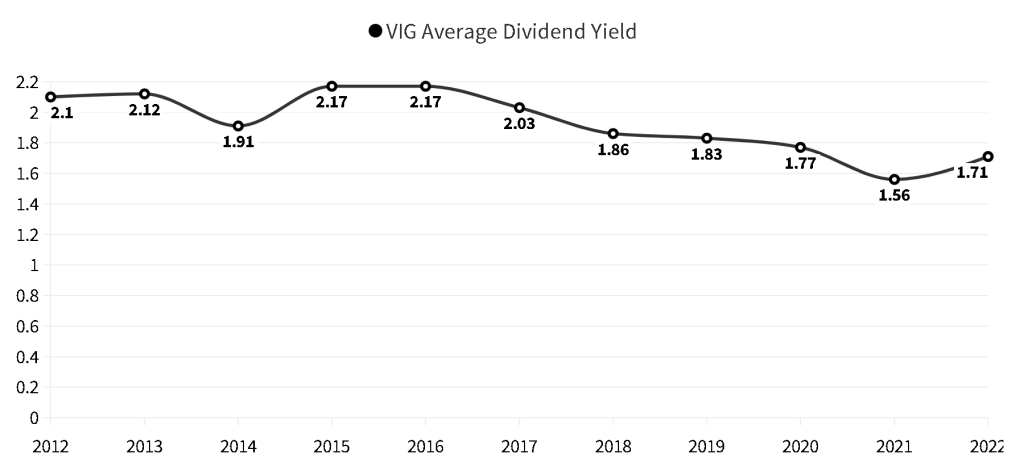

#4 Vanguard Dividend Appreciation ETF (VIG)

- Price: $175.1

- AUM: $79.38B

- Expense Ratio: 0.06%

- Dividend Yield: 1.71%

- Dividend Payout: Quarterly

- Last Year Total Return: 23.64%

- VIG Top Holdings: Microsoft, UnitedHealth, JPMorgan, Johnson & Johnson, Visa

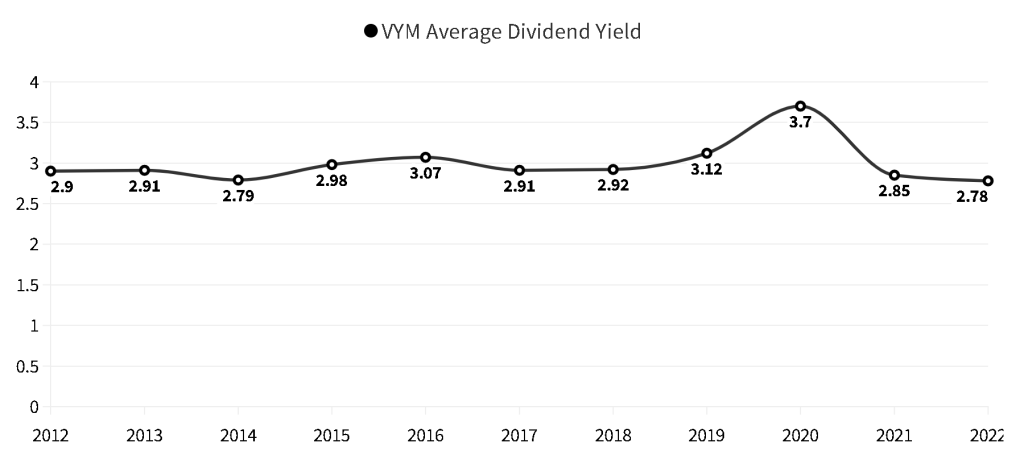

#5 Vanguard High Dividend Yield ETF (VYM)

- Price: $116.5

- AUM: $57.42B

- Expense Ratio: 0.06%

- Dividend Yield: 2.78%

- Dividend Payout: Quarterly

- Last Year Total Return: 26.14%

- VYM Top Holdings: Exxon Mobil, Chevron, Home Depot, Bank of America

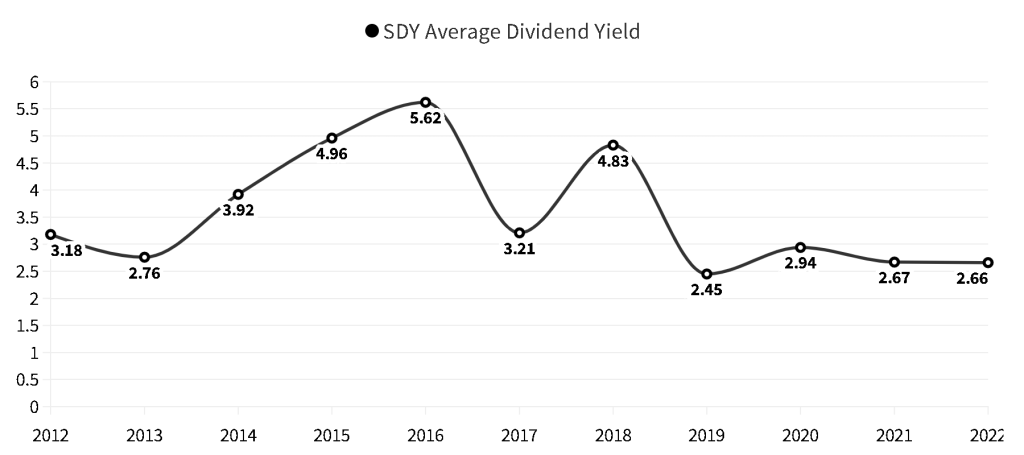

#6 SPDR S&P Dividend ETF (SDY)

- Price: $127.2

- AUM: $23.11B

- Expense Ratio: 0.35%

- Dividend Yield: 2.66%

- Dividend Payout: Quarterly

- Last Year Total Return: 25.37%

- SDY Top Holdings: IBM, Leggett & Platt, Amcor, Exxon Mobil

Related Post –

Best Monthly Dividend ETF (2023)

Generally, companies pay dividends quarterly (once every 3 months), but few provide dividends to their shareholders every month. Finding, tracking, and monitoring monthly dividend stocks can be challenging jobs. That’s why we created a list of some top monthly dividend ETFs you may consider for investment.

| ETF Name | AUM | Yield |

| JPMorgan Equity Premium Income ETF | $8.73B | 7.31% |

| Global X SuperDividend™ ETF | $821M | 11.42% |

| SPDR® FTSE International Government Inflation Protected Bond ETF | $552M | 10.49% |

| Invesco KBW High Dividend Yield Financial ETF | $438M | 9.00% |

| Franklin Liberty High Yield Corporate ETF | $297M | 6.61% |

| Invesco S&P 500 High Dividend Low Volatility ETF | $3.61B | 3.65% |

| Invesco Preferred ETF | $5.78B | 5.68% |

| Virtus InfraCap U.S. Preferred Stock ETF | $547M | 8.52% |

| Franklin Liberty High Yield Corporate ETF | $297M | 6.61% |

Dividend ETFs FAQ’s

The income you receive from dividends is taxable at the same rates (10% to 37%), which investors pay on ordinary incomes. But dividend income could be tax-free if you consider retirement accounts like 401(k) or IRA.

To make $1,000 per month in dividends, you will need to create a portfolio of ETFs or Stocks that payout at least $12,000 annually. If you use the average dividend yield of 4% per year, you’ll need a portfolio of $300k to generate that net income ($300,000 X 4% = $12,000).

Many people are out there increasing their income through dividend stocks/ETFs. The benefit is that the cash is paid to you automatically and on a quarterly and monthly basis because you hold shares in a company. These payments are an excellent way to create wealth and increase your passive income for retirement.

A dividend is an excellent way to generate passive income, but before investing, you need to understand the rule of diversification. The rule is simple never bid on a single line. To create a healthy portfolio, you need to choose those options with a safe, well-performing, and long-term future – So yes, you can invest in Dividend ETFs, but with a limited percentage of your total portfolio.

The first step in investing in dividend-paying stocks is to choose a brokerage; most investors use Charles Schwab, Fidelity, or Interactive Brokers. The next step is to set up auto-investing; most platforms offer this service. Lastly, decide the best ETF for your goals – you can do so by reading the above information. The final step is to open the broker app, search for ETF (You Want to Invest), enter a quantity, and click on the buy button.,

The Yield On Cost (YOC) is a dividend yield on the initial cost of security, calculated by dividing the current annual dividend by the cost of the security (When You Buy). For example, you bought XYZ ETF two years ago, which cost you $50, and now the current dividend is $5.50 per share; that means the YOC for that ETF would be 11% – If the YOC is higher than the current dividend yield that is a good thing.

Dividend Stocks For Other Counties –

0 Comments