The Current S&P 500 P/E Ratio is 24.72

Author @Abheey

The S&P 500 Price to Earning Ratio is a popular financial metric that helps an investor analyze the overall market valuation. In simple word P/E is how much they are paying for each dollar of earnings from the SPX 500 Index.

For example, a P/E ratio of 25 means that an investor is paying $25 for every $1 of earnings of the Standard & Poor's 500 Companies.

This ratio used to determine whether the US stock market is overvalued or undervalued. Like the Current PE ratio is 24.72, which is close to the average and indicates that the stock market is Overvalued."

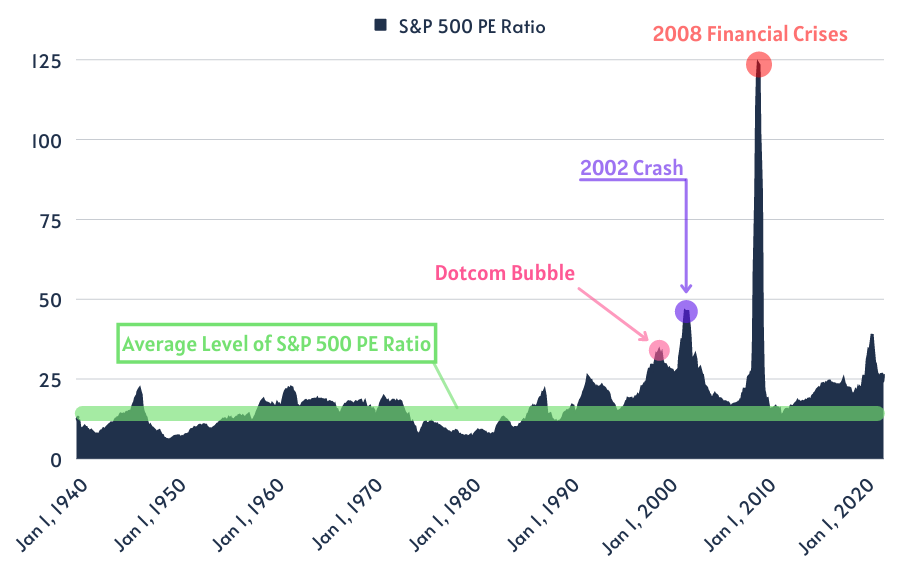

S&P 500 Historical PE Ratio (120+ Years)

Historical data shows that the average price-to-earnings (P/E) ratio for the S&P 500 was 13.34 between 1900 and 1980. However, over the next 40 years from 1981 to 2022, the average P/E ratio increased to 21.92. The highest ever P/E ratio for the S&P 500 occurred in May 2009, at 123.73, following the market crash. The lowest P/E ratio recorded for the S&P 500 was 5.31, which was observed in December 1917.

What is Price to Earning Ratio?

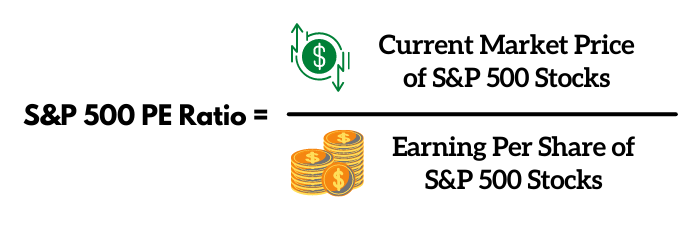

The P/E ratio, also referred to as the Price-to-Earnings Ratio is a financial metric that compares a company's stock price to its earnings per share. To calculate the P/E ratio, the market price of a single share of the company's stock is divided by the company's earnings per share.

Investors and analysts use the P/E ratio to assess the value of a company's stock relative to its peers in the same industry or sector. To calculate the Index PE Ratio, we required two elements: the current market price of the Index and S&P 500 Earning Per Share (EPS).

Reference: Chevron, an oil company, has made a profit of $10, $20, $35, $50, and $80 in the past five years. If the current stock price for Chevron is $1200, and the most recent earnings are $80, the P/E ratio for Chevron can be calculated by dividing the stock price by the earnings per share: $1200/$80 = 15

This means that an investor who buys a share of Chevron stock can expect to receive their initial investment back in 15 years based on the company's current earnings.

S&P 500 P/E Ratio Models

To get a more accurate valuation data of the S&P 500 index, you can compare the three types of P/E ratios:

1. Normal P/E Ratio

The regular P/E ratio is calculated by dividing the current market price of a company's stock by its earnings per share from previous periods. However, the accuracy of this ratio may be questionable as it is based on recent quarterly earnings, which is not reflecting the company's current performance or the average value over time.

2. Shiller P/E Ratio

The Shiller P/E Ratio also known as the cyclically adjusted P/E (CAPE) ratio, is determined by dividing the current price of a stock by the average inflation-adjusted earnings over the past 10 years.

The CAPE ratio is considered to be more accurate than the regular P/E ratio because it uses inflation-adjusted, 10-year earnings data to minimize the effect of short-term earnings volatility and allow for long-term comparisons."

3. Forward P/E Ratio

The forward price-to-earnings (P/E) ratio is used to evaluate the potential for future earnings growth and to compare the current stock price to the company's projected EPS.

However, it is important to understand that the forward P/E ratio is based on estimates and projections, and therefore, it may not always accurately predict a company's future earnings or performance.

Date | Forward P/E |

|---|---|

Q1-2023 | 25.41 |

Q2-2023 | 24.35 |

Q3-2023 | 23.55 |

Q4-2023 | 22.00 |

Q1-2024 | 21.47 |

Q2-2024 | 20.93 |

Q3-2024 | 20.23 |

Q4-2024 | 19.56 |

How to Analyze PE Ratio?

We already know the S&P 500 valuation by examining the various types of price-to-earnings ratios but to gain a deeper understanding of the overall market situation, it is crucial to consider a range of factors and carefully review historical data.

By comparing the S&P 500 P/E ratio with historical data, we can analyze how the US market is currently priced compared to the past and determine the best time to buy stocks for potential returns"

Important Levels of P/E Ratio

"The historical average price-to-earnings (P/E) ratio for the S&P 500 is generally between 18 and 22. If the current P/E ratio is close to this average, it may be a good time to invest as the market is likely to be fairly valued based on past performance. But, the P/E ratio is higher than the average, the market may be overvalued or expensive, and prices may potentially decrease in the future.

However, it is not advisable to make trading decisions based on the P/E Ratio. Because If the market is reversing after a downturn and the price-to-earnings ratio indicates that it is still overvalued, short selling based solely on the high P/E ratio could potentially result in losses.

That's why every trader should consider a range of factors, including market sentiment, technical analysis, and fundamental analysis to be in market.

PE Ratio vs. Price vs. Interest Rate

In the process of wealth creation, no Investment decision can be taken based on just the PE ratio. You have to compare many different metrics and understand the relationship between them. In the below chart, you can easily compare and observe the S&P PE ratio with an all-important indicator -

- To understand "How Interest Rate Works, " check this Post - 10-Year Treasury Yield

Is S&P 500 (Market) Overvalued?

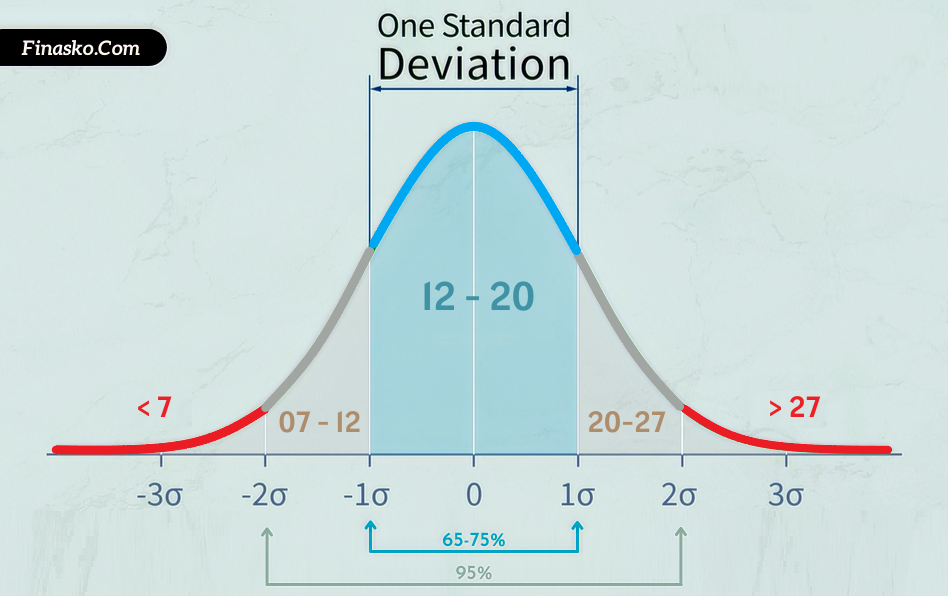

If you want to analyze whether the stock market is overvalued or undervalued using the P/E ratio, the One Standard Deviation measure can be helpful. This single image gives you an overview of how the S&P 500 P/E ratio has typically performed over the past 100 years.

P/E Ratio Standard Deviation

The current price-to-earnings (PE) ratio for the S&P 500 is close to the historical average PE. Additionally, the standard deviation shows that 70%-75% of historical markets have had a range of PE levels between 12 to 20. This suggests that the current market is fairly valued.

However, to gain a more comprehensive understanding and minimizing the impact of short-term market volatility, you may also want to consider other valuation models such as the Yield Curve, Buffett Indicator, Margin Debt, and Mean Reversion.

Faq's

The estimated current S&P 500 P/E ratio is 21.97, while the Shiller P/E is 29.27. The regular P/E ratio is based on the previous quarter's earnings and the current index price, so it can be difficult to determine its exact value. However, you can use various valuation models to get a better understanding of the market's valuation.

An average or below-average P/E ratio is often attractive to investors because it typically indicates that stocks are selling at a lower price than their intrinsic value. On the other hand, a P/E ratio that is higher than average or significantly above average is usually not good, but it also depend on the market structure and sentiments.

As I mentioned earlier, the P/E ratio is a useful valuation tool, but to get a complete picture of a company's value, it is necessary to also consider other factors such as fundamentals, technical analysis, investor sentiment, and other valuation models.

Disclaimer

The information provided in this article is not financial or investing advice. The author does not make any warranties about this information's completeness, reliability, and accuracy. The cryptocurrency market is volatile, and it can be difficult to predict which coins will rise and fall in value over time. Any investor should research multiple viewpoints before committing to an investment.